Company A is able to generate 1M in Net Sales with $100k in Total Assets.

In another example, consider Company A & Company B. It’s telling you that your company is able to generate more Sales with less assets. Whereas a less efficient firm is generating equal Sales with more assets. The rule of thumb here is, the smaller the number or percentage, the better.

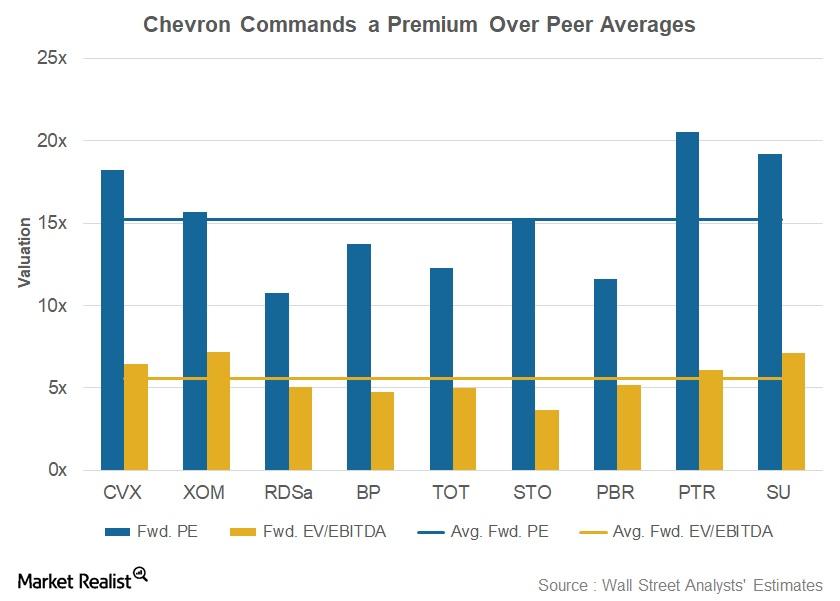

So as in our example, once you determine a ratio such as Assets to Sales, then, you refer to some comparative data to determine how your company is performing on this Key Performance Indicator (KPI) or ratio. Industry average financial ratios are available from various sources, such as:įinancial Ratios are important because they give you a standardized measure. So you can compare and track performance over time and against industry peers. In industry comparisons, compare the ratios of a firm with those of similar firms or with average industry ratios to gain insight. Industry comparisons– Comparing a company’s performance to industry peers (benchmarking).This analysis determines the future viability of the business. Trend analysis examines ratios over comparable periods. Compare a firm’s present ratio with its past to project expected future ratios. Then, you can determine whether the company’s financial condition is improving or deteriorating over time. Trend analysis– Comparing a company’s performance from one period to another (current year vs last year, etc.).In other words, Financial Ratios compare relationships among entries from a company’s financial information.Īt a basic level, ratios make two types of comparisons: Industry comparisons and trend analysis. A ratio shows how many times the first number contains the second number.įor example, an Assets to Sales Ratio = Total Assets / Net Sales Sometimes it expressed as a quotient of the two numbers. It is usually expressed as “a to b” or a : b. Ratio Analysis is a comparison of relationships among account balances.Īny analysis of Financial Statements involves the calculation of various ratios:Ī relationship between two numbers. Horizontal and Vertical Analyses compare one figure to another within the same category and ignore figures from different categories.īut it is also essential to compare figures from different categories.

0 kommentar(er)

0 kommentar(er)